NYC Property Tax Incentives & Benefits

Property Tax Exemptions and Abatements incentive calculations are an important part of the financial analysis of a new construction or a rehabilitation development for the residential, commercial or mixed-use projects.

What We Offer

We offer advisory services to make the most effective use of the continuing tax benefits available in the New York real estate market for residential, commercial, hotel, and mixed use projects.

421-a(16) Affordable Housing New York Program (AHNYP)

421-a(16) Affordable Housing New York Program (AHNYP)

- Unit Mix Analysis

- 421-a(16) Workbook filing

- 421-a(16) Tax Exemption filing

Industrial & Commercial Abatement Program (ICAP)

Industrial & Commercial Abatement Program (ICAP)

- Preliminary Application filing

- Final Application Filing

- Notice of completion Filing

J-51 Tax Exemption Program

J-51 Tax Exemption Program

- Eligibility and benefit analysis

- Application submission

- Physical inspection

Tax Benefits Reinstatement

Tax Benefits Reinstatement

- Preliminary Case Analysis

- Settlement Agreement Negotiation with the Agency

- Settlement Conditions Execution

Project's Tax Benefits Eligibility Analysis

Project's Tax Benefits Eligibility Analysis

- Preliminary research

- Applicable programs eligibility verification

- Projected tax benefits calculations

Tax Benefits Opinion Letter

Tax Benefits Opinion Letter

- Lenders/Investors requirements confirmation

- Applicable programs eligibility verification

- Projected tax benefits calculations

Trusted and Partnered with

Powered by

Complibuddy Tax Software

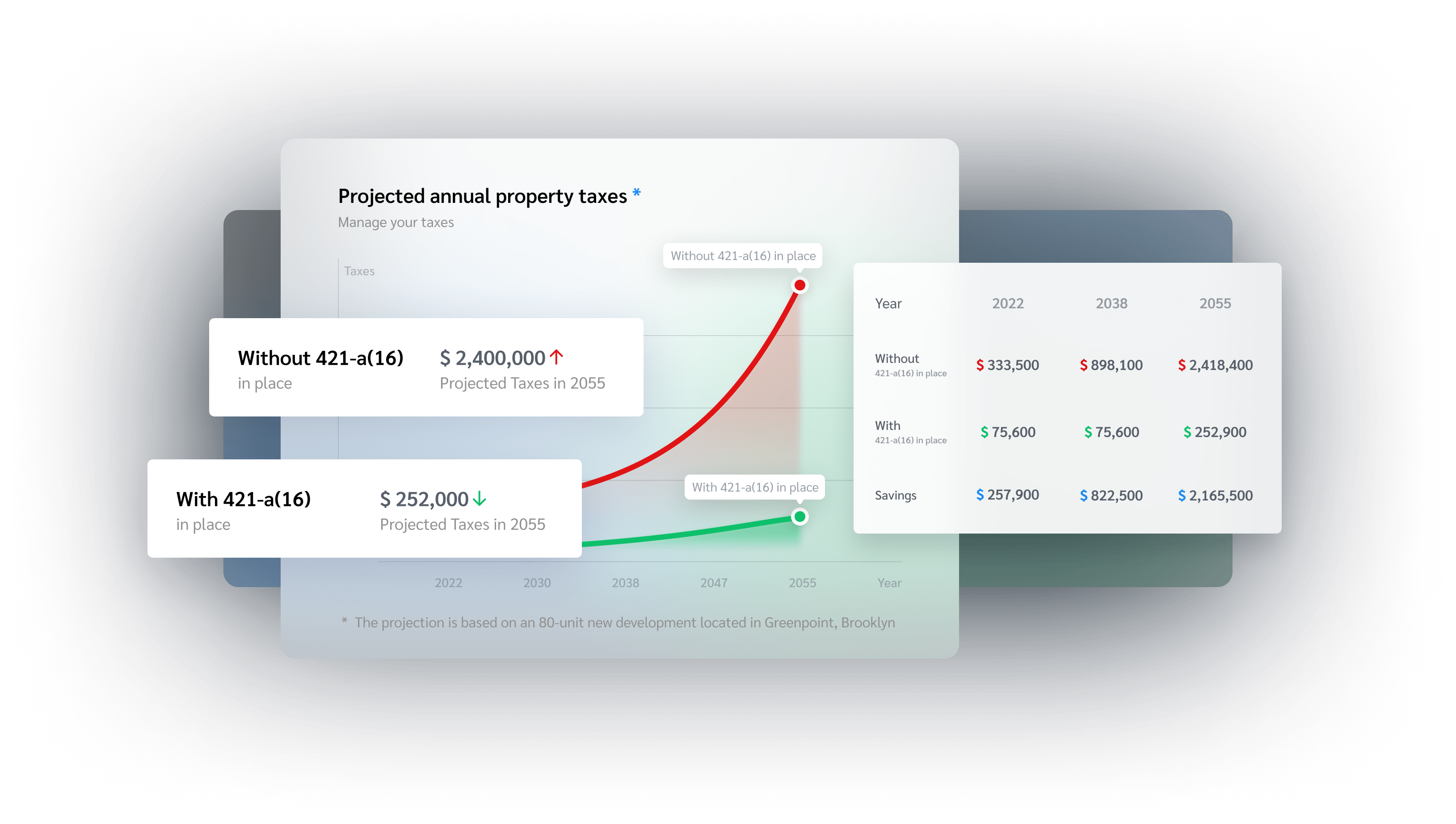

Financial analysis and tracking of tax exemption and abatement incentives made easy with comprehensive reporting and case management. To schedule a property tax projection meeting or to find out whats happening check out our latest news.

100%

100% approval rate of the 421-a(16) tax exemption applications

500+

Over 500 affordable units created

77M+

More than 77 Million dollars saved in taxes under the 421-a(16) Tax Exemption

19.6%

19.6% increase in square footage area through the Voluntary Inclusionary Housing Program

Development Locations

Check where our developments are located

Frequently Asked Questions

Find answers to commonly asked questions below

What is 421-a(16) workbook?

A 421-a(16) workbook compiles the information needed to determine whether the requisite percentage of the dwelling units in the rental projects meets affordability options A, B, C, E, F or G in accordance with the provisions set forth in the Real Property Tax Law Section 421-a (16) and Chapter 51 title 28 of the Rules of the City of New York.

When should I file a 421-a(16) workbook?

At least 9 months prior to anticipated construction completion

When can I file a 421-a application?

- 421-a(16) Certificate of Eligibility Application filing

- After the property receives a (T)CO and marketing of the affordable units has begun, an application for a certificate of eligibility for 421-a(16) can be submitted to HPD

- HPD application fee is $3,000.00 per affordable unit

- DOF 421-a application filing

- Once the 421-a(16) Certificate of Eligibility is issued an application to DOF can be submitted

- The construction exemption will be applied retroactively and the tax benefits will be effective from the date of the issuance of the TCO or CO

Who benefits from the J-51 program?

- The J-51 tax abatement is an exclusive benefit given to some building owners.

- Eligibility is contingent upon the structure being renovated or owners having a plan to convert a commercial or industrial structure into residential.

Do the ICAP benefits have eligibility upon location?

- Manhattan South of 59th St./North of Murray Street (Excluding Garment Center)

- Less than 5% Retail use

- 10-year benefit schedule for renovations

- No Inflation Protection

- Manhattan - Garment Center

- Less than 5% Retail use

- 12 year benefit schedule for renovations

- No Inflation Protection

- Manhattan - South of Murray St.

- Less than 5% Retail use

- 12 - year benefit schedule for renovations 8-year benefit schedule for new construction of "Smart Buildings"

- No Inflation Protection

- Special Area - High Needs Neighborhoods

- Commercial space and up to 10% of building for Retail

- 25-year benefit schedule Remaining Retail portion of building above 10% 15-year benefit schedule

- Yes Inflation Protection

- Regular Areas - All areas not included above, excluding Manhattan between 59th and 96th.

- No retail restriction

- 15-year benefit schedule for renovations or new construction.

- No Inflation Protection

This site is protected by reCAPTCHA and the Google Privacy policy and Terms of Service apply.